| Los Angeles | New York | London | Dubai | Beijing | Tokyo |

History

The origins of SFI's specialization in regional aircraft finance extends back to early 1993 when some current and former members of the SFI team worked within Bombardier's Structured Finance Group, which was managed by former SFI principal Ed Holub. These individuals led the manufacturer's pioneering efforts to successfully finance the very first CRJ deliveries. Additional members experience extends back to 1994 when as part of the structured finance group at a large, publicly traded finance company (Newcourt Capital, now part of CIT) they were providing and sourcing new aircraft financing, primarily for regional aircraft.

In 1997, the Bombardier and Newcourt contingents of what is now SFI joined forces to create an advisory services based structured finance group at Newcourt that specialized in regional aviation financing (from aircraft to enterprises).

The SFI team has developed and adopted a full service approach to the market utilizing their unique ability to analyze transactions from the perspective of all key participants in order to create structures that were compatible with each participant's internal requirements, approval processes, accounting and economic objectives.

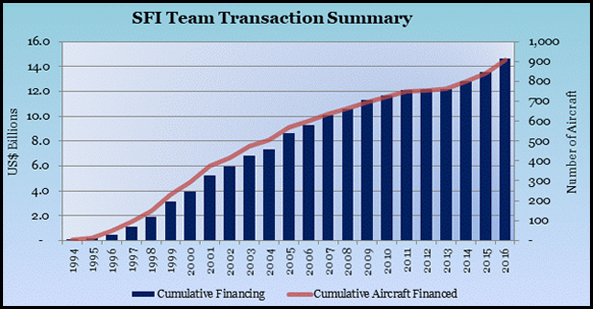

This full service philosophy provided significant transaction pipelines to SFI and enabled the establishment of scalable, volume driven, highly efficient transaction processes. This is evidenced by the chart below which reveals a consistent, high volume focus on regional aircraft financing dating back to the team's origins.